EXPLORING THE CCCC PENSION PLAN

If you are considering joining a pension plan to assist with your employees’ retirement, we commend you for that decision. We trust the CCCC Plan will provide you with a worthwhile option to consider.

This page has been created to expand on the summary information provided in the pension brochure. Let’s arrange a time for a phone chat after you’ve had an opportunity to review this information. Please contact us or call 519.669.5137 to speak with our team, who will be glad to assist you.

There are three main reasons CCCC member organizations choose the CCCC Pension Plan: Professional Oversight, Reduced Fees, and Enhanced Services.

Professional Oversight

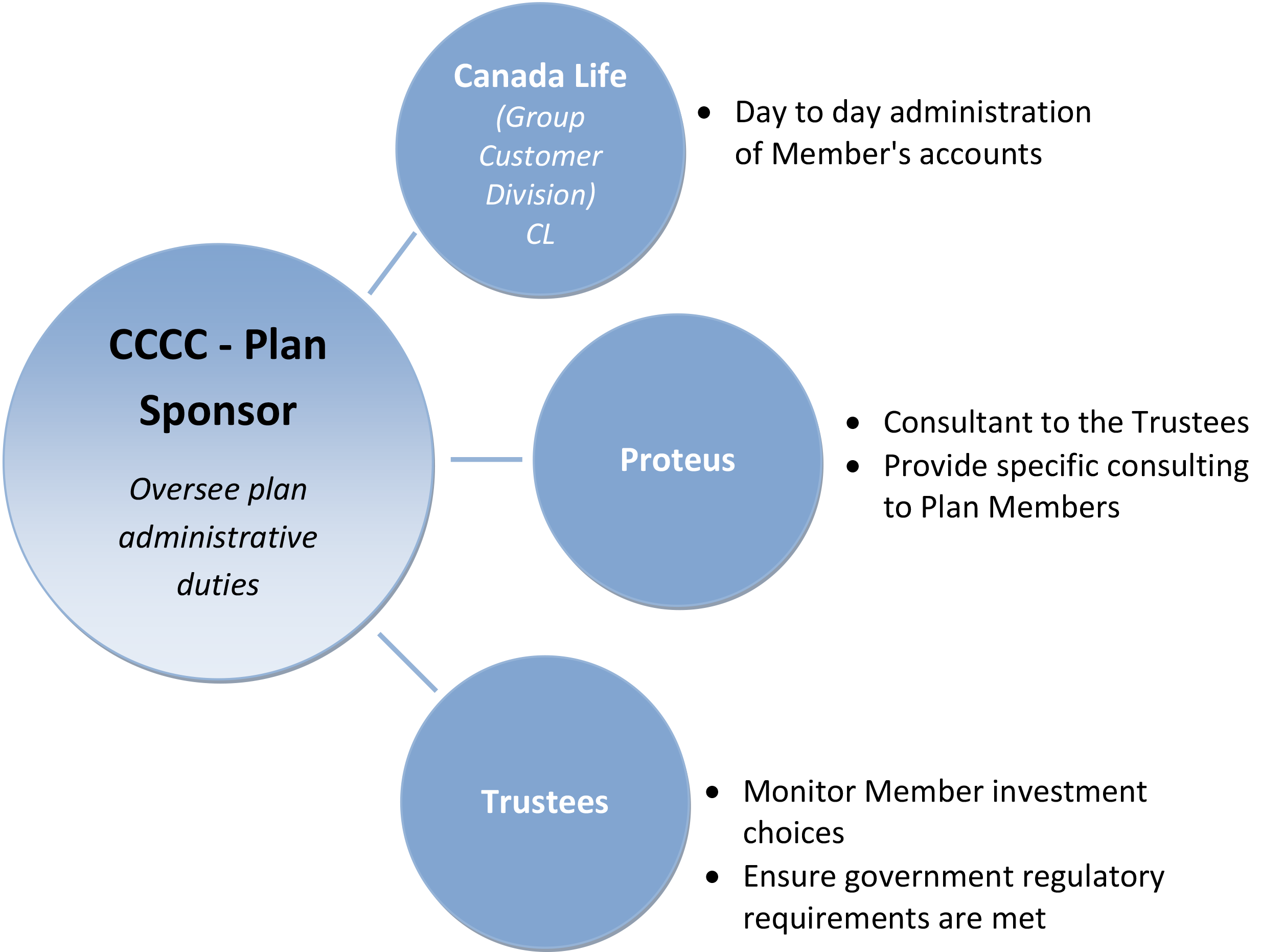

The plan is registered with the Financial Services Regulatory Authority of Ontario (FSRA), Canada Revenue Agency, and all provincial jurisdictions in Canada. CCCC is the Plan Sponsor, having set up the plan in 1982, and retains the on-going responsibility for ensuring the plan meets legislative requirements and operates properly.

The CCCC Board assigns Trustees to provide oversight of the plan. The Trustees ensure government regulations are met and that prudent, well-researched investment options are offered to the plan Members.

The Trustees hire and assign the plan’s administrative team. The administrative team is made up of:

- CCCC employees who provide various administrative functions, the plan’s internet presence and audited financial statements.

- Canada Life’s Group Customer division for direct support of plan Members, their personal accounts and to provide educational services.

- Proteus Performance Management provides both professional advice and guidance to the Trustees.

This professional oversight reduces your workload, enabling you to focus less on managing a group retirement plan and more on fulfilling your organization’s mission.

CCCC and the plan’s administrative team serve the Participating Employers and their employees, as plan Members. Note: To become a Participating Employer in the Plan, the employer must be a CCCC Member.

Reduced Fees

Because of the “buying power” of a large multi-employer plan, plan members benefit from investment fees significantly lower than what they would pay with a “retail” plan (e.g. RRSP through a financial institution or insurance company). Over time, reduced fees significantly impact the balance of funds available to plan members when they retire.

All other administrative costs related to the plan are taken from the earnings of the plan members’ investments. The fees average is 0.88% of the plan member's fund balance depending on the fund(s) selected by the plan member.

Enhanced Services

Being part of a professional group plan means that you and your employees will have access to many enhanced services. The provider of each service is indicated in parenthesis. These services include:

- Personalized enrollment package to assist you with onboarding new employees (Canada Life)

- 24/7 access to the plan by phone and online for plan members to review their account, make investment choices, or update their information (Canada Life)

- Quarterly newsletter with Plan updates, a market review, and other helpful topics related to planning for retirement (PROTEUS)

- Semi-annual statements (Canada Life)

- Retirement planning tools and educational programs (Canada Life)

- Dedicated Investment and Retirement Manager for plan members to speak with (Canada Life)

The Plan is a Registered Pension Plan (RPP), registered with applicable government bodies. It is designed to provide a tax-sheltered means to accumulate contributions and earnings to produce retirement income. Unlike a Registered Retirement Savings Plan (RRSP), which allows taxable withdrawals anytime, an RPP requires funds be held until retirement. Retirement payments can begin as early as age 55 but must start no later than the end-of-the-year in which the Member turns age 71. Limited early access to the account is allowed in specific circumstances (e.g. due to death, or serious illness leading to death).

When your organization joins the Plan, it is referred to as a Participating Employer. Your employees are subsequently enrolled in the Plan and then referred to as Plan Members. If a Member leaves the employ of a participating Employer, the Member may:

- Retain their account in the Plan (though no further contributions are allowed), or,

- Transfer their funds to a locked-in retirement savings account elsewhere (e.g. with a new employer).

Two important documents are: the Plan Text and Declaration of Trust. The Plan is governed by these documents, which are in compliance with pension legislation. Please note, the rules for Ontario employees are the default rules in the first half of the plan text. Any rules that differ in other provinces are included in the corresponding appendix.

Full-time employees may join the Plan after completing their employer's requirements for eligibility. When certain conditions specified in your province’s Pension Benefits Act apply, part-time employees are also eligible. You will find specific details on eligibility in Section 3 of the Plan Text.

The Plan is a Defined Contribution RPP. The type and amount of contributions made into the Member’s account are defined below.

The 3 types of contributions are:

1. Employer - Employer contribution amounts are set out in a contract between your ministry and the Plan called a Participation Agreement. Though a Participation Agreement can be amended, the Plan Text always requires a minimum 5% Employer rate. The majority of participating employers choose a 5% employer contribution rate, with some choosing a higher rate. This aligns with the industry median of 5-6%.

2. Employee - Employee contributions are not required by the Plan, but the employer can decide to make them a requirement. An Employee rate must then be set out in the Participation Agreement. Employee contributions are strongly encouraged, to provide both a disciplined savings method for retirement, and, to accumulate sufficient contributions and earnings that will produce adequate retirement income. The majority of participating employers require a 5% employee contribution rate.

3. Voluntary (by the Member)- Voluntary contributions are exactly as they sound – at the discretion of the Member.

Employee and Voluntary contributions are made from the Member’s income after CPP contributions and EI premiums have been applied, but, are exempt from income tax at source, since they are sent by the employer into an RPP account. An Employer RPP contribution has special status in the Income Tax Act that exempts it from statutory deductions (CPP, EI and Income Tax). Contributions are sent to CCCC each month and then forwarded on to Canada Life.

The total of Employer, Employee and Voluntary contributions cannot, by law, exceed the lesser of 18% of the Members earnings or the maximum dollar amount set by the Canada Revenue Agency annually.

The following investment options are available to plan members:

- Target Date Funds (Fidelity ClearPath Portfolios)

- Money Market Fund - Mackenzie Canadian Money Market

- Bond Fund - MFS Fixed Income

- Balanced Fund - JF Balanced and Mackenzie SRI Balanced

- Global Equity - Mawer Global Equity

- Canadian Equity - JF Canadian Equity, Mackenzie SRI Canadian Equity

- U.S. Equity Fund - MFS American Equity

- International Equity Fund - MFS International Equity

The Plan receives Quarterly Performance Reports from its consultant, Proteus Performance Management. The performance of the funds is compared to benchmarks for that investment class in order to ensure that the investment options are performing as set out in the Plan's Statement of Investment Policies & Procedures.

A personalized employee enrollment guide includes access to a questionnaire that will help employees determine what type of investment mix is best for them. The guide also includes other helpful instructions for the employee to get acquainted with their plan and navigate their online account access.

A Member’s retirement income will depend upon the amount of accumulated contributions and earnings put into the account, and the nature of the payout mechanism the Member chooses. The Plan provides professional counseling to Members nearing retirement.

The trustees have engaged the services of licensed public accountant to conduct the annual audit and express an opinion on the financial statements of the CCCC Employee Pension Plan. Recent financial statements for the Plan are provided below.