CRA form T1213 Request to Reduce Tax Deductions at Source may be filed by employees with CRA to request that CRA provide a Letter of Authority – which CRA will direct the employee to give to their employer – to reduce tax withholdings at source for non-basic tax credits or deductions that are not part of CRA’s standard form TD1 Personal Tax Credit Return.

CRA amends the T1213 from time to time, and employees must be sure to review it carefully each time they make this type of submission to CRA.

Below is a quick review of what the T1213 and some recent changes charities and their employees need to be aware of.

What Does the T1213 Form Cover?

The T1213 form allows employees to request that CRA consider allowing for reduced taxes at source for tax deductions and credits that may apply to charity employees, such as:

- Clergy residence deductions

- Medical expenses

- Childcare expenses

- RRSP contributions

- Foreign tax credits

Submitting a T1213 is a voluntary choice, not a mandatory submission. Employees do so to access tax relief and higher net pay each pay period that they may otherwise have had to await a refund for after filing their tax return the following year.

The T1213 process doesn’t reduce the total tax owed but could help manage personal cash flow, giving employees access to more of their after-tax earnings now.

It’s also important to note that the CRA does not “rubber stamp” T1213 submissions. Though getting the CRA’s Letter of Authority to reduce tax at source is the goal, if the CRA does not issue it, it could represent a pre-determination by the CRA that the employee is not entitled to the deduction or credit. This, in turn, may mean the employee cannot claim the deduction or credit when filing their tax return for that year.

Accordingly, employees seeking a tax reduction at source should consult with their financial professionals. For further information, members can read our article in the CCCC Knowledge Base, “Getting Taxes Reduced At Source.”

Key Changes to the 2024 T1213 Form

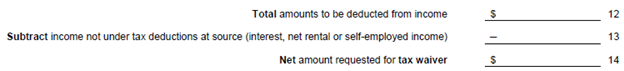

As recent as 2023, Part 3 of the T1213 form had three key lines at the bottom that required attention regardless of which deductions an individual sought to reduce:

- Line 12: Total amount of deductions

- Line 13: Total amount of income not under tax deductions at source

- Line 14: Net amount of the two above, which was the requested amount for the tax waiver

This structure required employees to calculate the net result of their deductions and other income to determine the specific amount they were requesting to CRA be waived from tax withholding. For many long-time users of the form, this process was routine, but it did require precision in calculations.

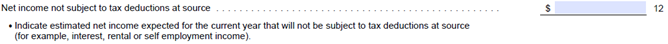

The 2024 version of the T1213 form has introduced a subtle but important change:

Part 3 now ends at Line 12 and uses the 2023 definition of Line 13—“total amount of income not under tax deductions at source.” In other words, employees filling out the 2024 form no longer need to calculate the net result of deductions and income not under deductions, and the CRA has removed the need for claimants to enter a final waiver amount.

Why These Changes Matter for Charities

This change is worth noting for charities and their employees, particularly those who have been filing T1213 forms for many years. The new layout simplifies the process by removing the final calculation, reducing potential errors. However, those previously used to completing Line 14 may still try to calculate and enter a net amount here by habit, leading to potential errors.

This change also means that charity payroll departments must be aware of the updated process. While the CRA still has the responsibility for calculating withholdings, employees need clear guidance on completing the form correctly. Failure to do so could result in delayed processing or even rejected applications, which may affect an employee’s ability to benefit from reduced tax withholdings throughout the year.

What Charities Can Do

- Communicate the change: Charities should ensure that their employees, especially clergy and those handling payroll, are aware of the updated T1213 form and its simplified structure.

- Offer guidance: Encourage employees to review the form carefully before submission and remind them that the CRA will handle any calculations of the waiver amounts. They no longer need to enter a final figure themselves.

- Update internal processes: Payroll departments should be prepared to handle new instructions from the CRA and adjust withholdings based on the CRA’s updated guidance after an employee’s form is processed.

Final Thoughts

The T1213 form is an optional tool for charity employees to manage their tax withholdings each pay period, but it does increase their interactions with the CRA. The recent 2024 T1213 changes offer a simpler approach. However, it’s helpful for charities to communicate these changes to employees who file T1213 forms with the CRA to prevent unnecessary errors or delays in processing.