CRA released a new T3010 this month, January 2024.

The Essentials

Charities with fiscal year ends on or before December 30, 2023 need to file their T3010 using the current form – version 23.

Charities with fiscal year ends on or after December 31, 2023 need to file their T3010 using the new form – version 24.

It’s important to use the correct form. If you use the wrong form, CRA will send it back to you and you’ll need to complete and file your return using the correct form.

Version 23 of the T3010 made updates to account qualifying disbursements, including Form T1441, Qualifying Disbursements: Grants to Non-Qualified Donees.

Version 24 of the T3010 makes updates to Disbursement Quota requirements (an entirely new schedule), asks Foundations additional questions, requires specific information about donor advised funds, updates some language and makes adjustments to Schedule 6, Detailed Financial Information . Form T1441 has also been updated – if activities were carried on outside of Canada, it now asks for the country code.

The Details

What are the main changes to T3010 version 24?

Section C, Programs and General Information

In Section C there are some minor revisions and a bit of restructuring to improve readability.

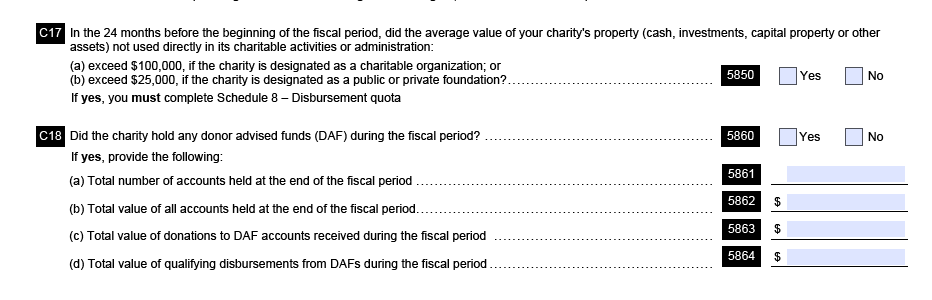

There are also two new questions:

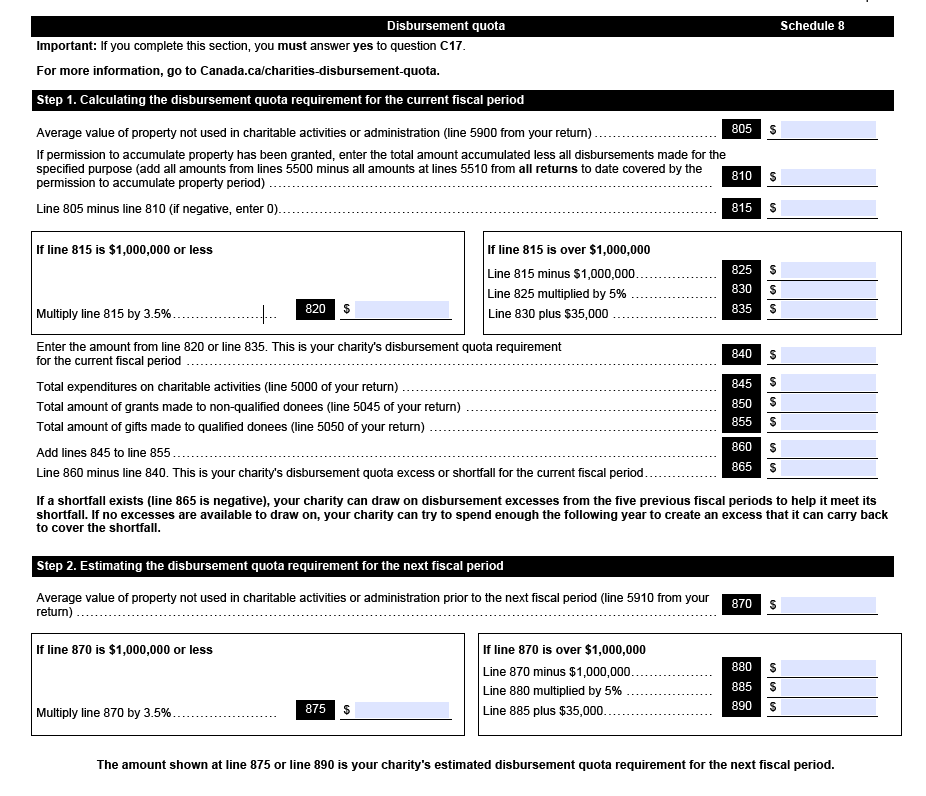

- C17 asks about the average value of the charity’s property. This helps charities calculate the Disbursement Quota. As of January 1, 2023 the disbursement quota increased from 3.5% to 5% for the portion of property not used in charitable activities or administration that exceeds $1M.

- C18 asks about donor advised funds (DAFs). CRA’s guide, Completing Form T3010 defines DAFs as “a fund segregated into donor accounts, owned and controlled by a registered charity” where “each account is comprised of contributions made by individual donors” and where “donors may provide ongoing non-binding suggestions on payouts from DAFs.”

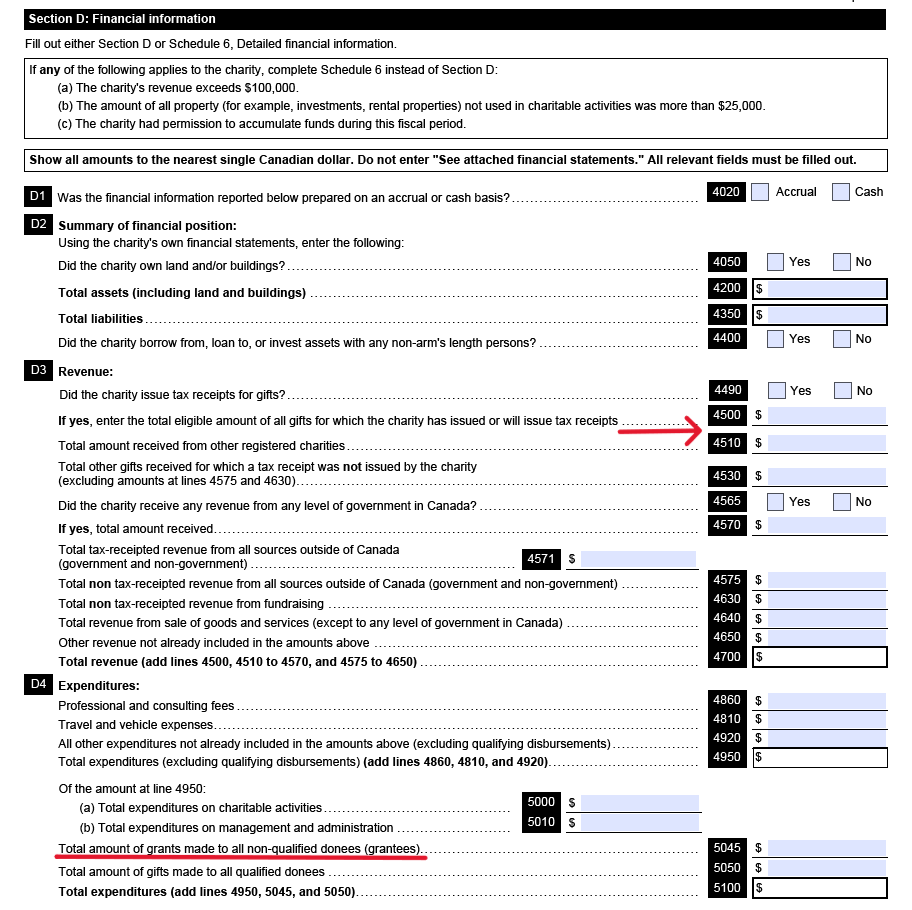

Section D, Financial Information

In Section D, line 4505 for 10year gifts received has been removed and line 5045 has been revised from “Total grants made to non-qualified donees (grantees)” to “Total amount of grants made to all non-qualified donees (grantees).”

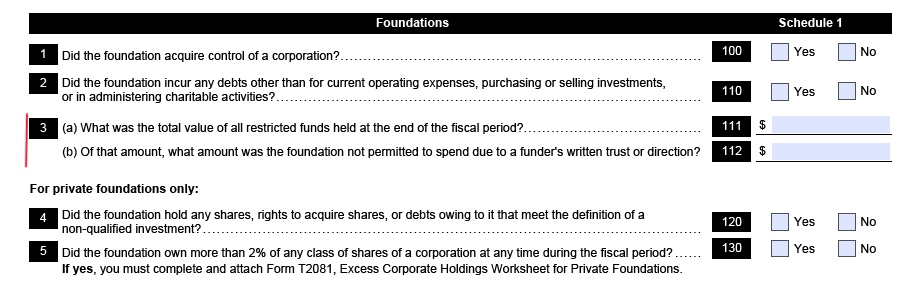

Schedule 1, Foundations

Schedule 1 adds a new question for public and private foundations about the value and spending of restricted funds.

- What was the total value of all restricted funds held at the end of the fiscal period? Restricted funds means generally “those where a funder (including a donor, grantor, lender, or payer) limits how the funds can be spent.”

- Of that amount, what amount was the foundation not permitted to spend due to a funder’s written trust or direction? This refers to when “a funder requires the foundation to preserve the capital (principal), and the foundation is only permitted to spend the income.”

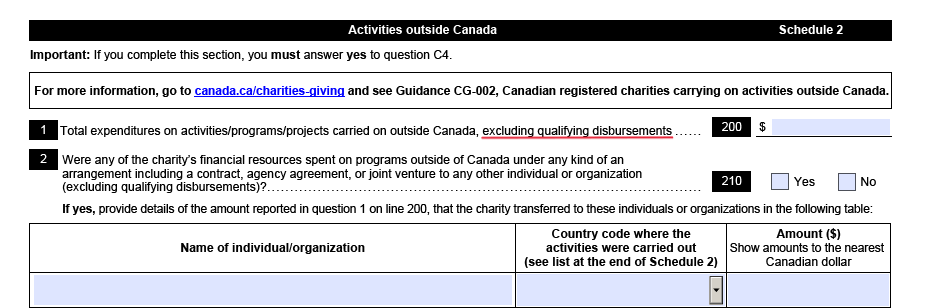

Schedule 2, Activities Outside Canada

Schedule 2 has a minor revision. Instead of asking for total expenditures on activities/programs/projects carried on outside of Canada, “excluding gifts to qualified donees”, it now reads “excluding qualifying disbursements”.

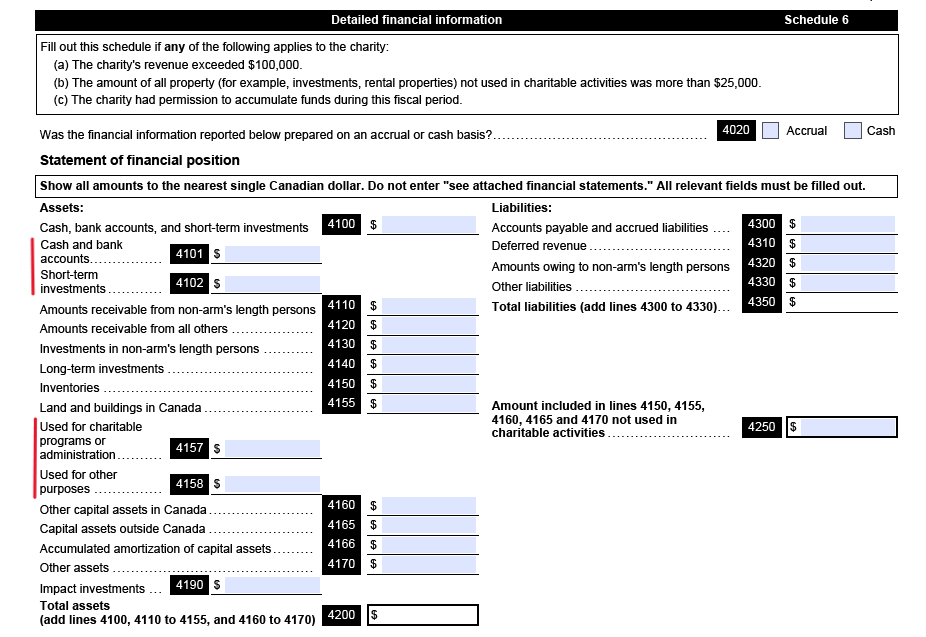

Schedule 6, Detailed Financial Information

Schedule 6 has a number of changes:

Under Statement of Financial Position: Assets

- Line 4100, Cash, bank accounts and short-term investments, is broken down into two subsections:

- New line 4104 for cash and bank accounts

- New line 4102 for short-term investments (meaning that the original term to maturity not greater than one year)

- Line 4155, Land and buildings in Canada, is broken down into two subsections:

- New line 4157 for “used for charitable programs or administration”

- New line 4158 for “used for other purposes”

- Removed line 4180 for 10-year gifts

- Revised line 4200 to reflect the lines contributing to “total assets”

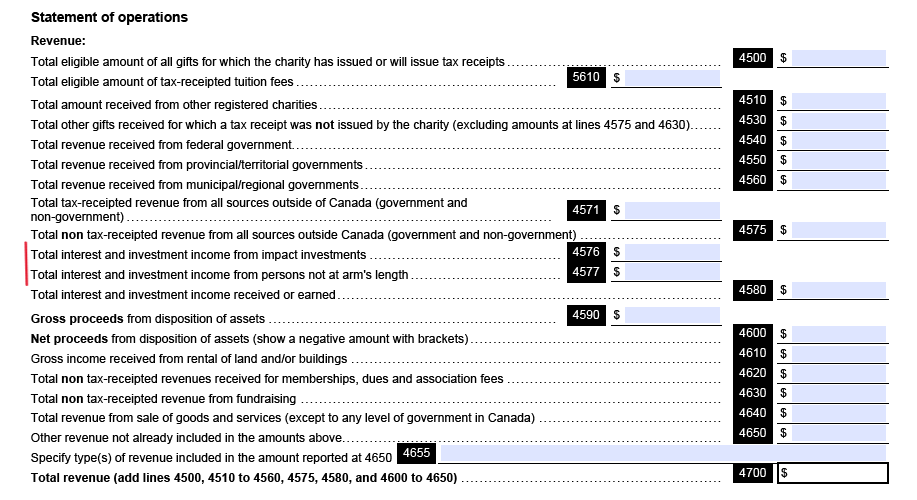

Under Statement of Operations: Revenue

- Line 4580, Total interest and investment received or earned, separates two specific categories:

- New line 4576 for “total interest and investment income from impact investments”, defined as “investments in companies or projects with the intention of having a measurable positive environmental or social impact, and generating a positive financial return.”

- New line 4577 for “total interest and investment income from persons not at arm’s length”

- Removed line 4505 for total amount of 10-year gifts

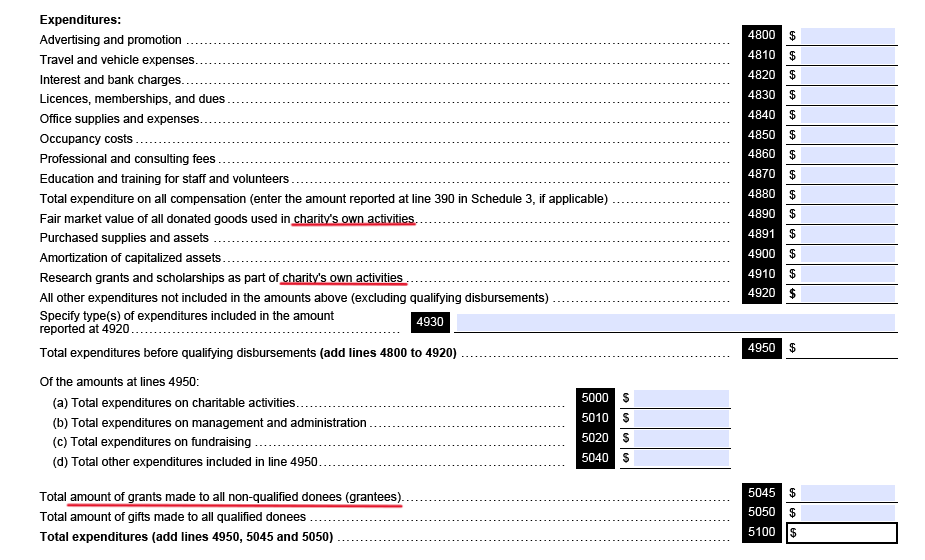

Under Statement of Operations: Expenditures

- Revised line 4890: “Fair market value of all donated goods used in charity’s own activities

charitable services” - Revised line 4910 for “Research grants and scholarships as part of charity’s own

charitableactivities” - Revised line 5045 for “total amount of grants made to all non-qualified donees (grantees)”

Schedule 8 is an entirely new schedule for Disbursement Quota; it is only completed if a charity answers yes to C17.

CRA T3010 Guide

You can find the T3010 forms from CRA’s T3010 Registered Charity Information Return Page. CRA’s Guide T4033, Complete Form T3010 Registered Charity Information Return has been updated to provide instructions on how to complete the new T3010 and T1441.

CCCC’s Fillable T3010

Did you know that CCCC has developed a CRA-approved, fillable, saveable T3010 to assist you in completing your T3010? CCCC has both version 23 and version 24 ready for your use! If you’d like, you can print out a blank T3010 as a working copy. We also recommend that you consult the CRA’s guide when completing your return.

CCCC’s online return includes:

- the T3010 and accompanying schedules

- the Directors/Trustees Worksheet (T1235)

- the Qualified Donees Worksheet (T1236)

- the Qualifying Disbursements: Grants to Non-Qualified Donees Worksheet (T1441)

- helpful information pop-ups and validation checks to reduce errors when completing your return

Members can also access CCCC’s T3010 Guidance for additional information and support.

The content provided in this blog is for general information purposes and does not constitute legal or professional advice. Every organization’s circumstances are unique. Before acting on the basis of information contained in this blog, readers should consult with a qualified lawyer for advice specific to their situation.