The Canada Revenue Agency (CRA) recently released its Report on the Charities Program 2021 to 2022. It covers CRA’s Charities Directorate activities from April 1, 2021 to March 31, 2022. The report contains a variety of information about CRA’s role, consultations, revenue streams, audits, revocations, anti-terrorism monitoring, policy priorities, etc.

Below we highlight just a few items of interest.

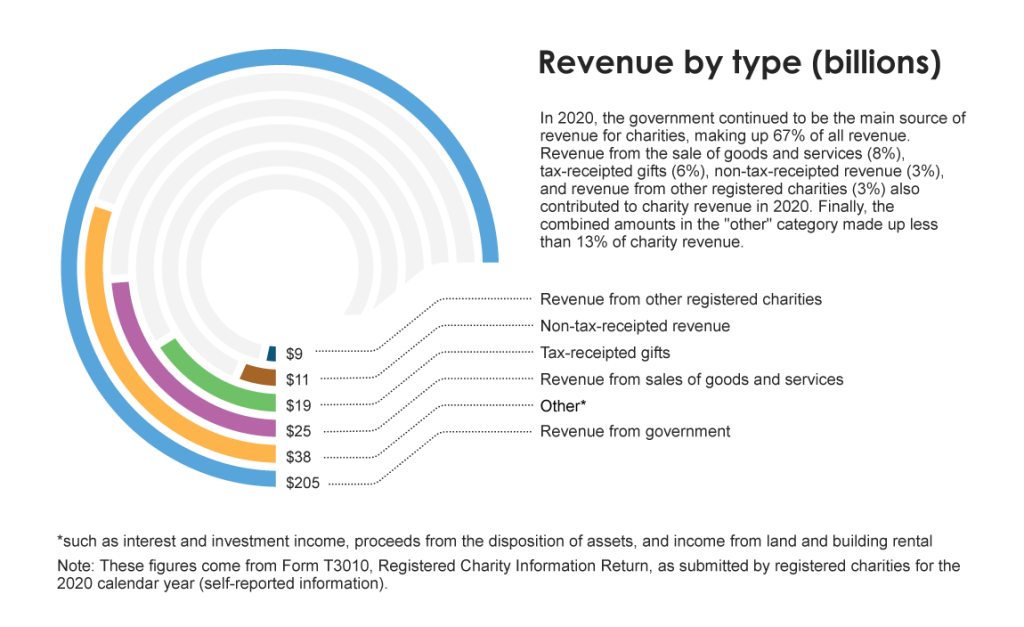

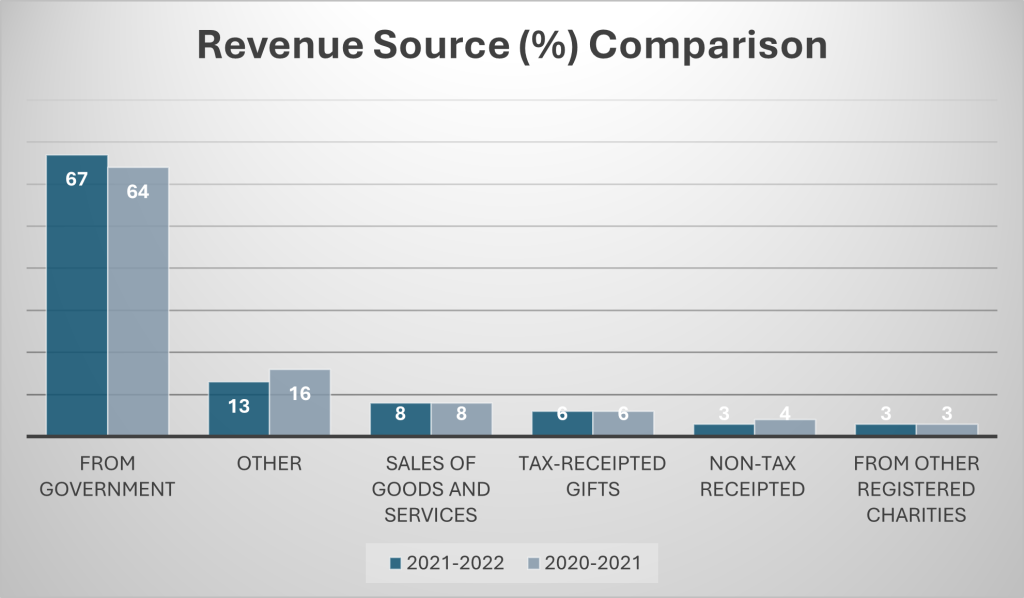

REVENUE SOURCES

The report shows two-thirds (67%) of charities’ revenue comes from the government. This is a 3% increase from the Report on the Charities Program 2020-2021, which had government funds at 64% ($199B) of charities’ revenue. At the same time, revenue from the “other” category (interest, investment income, rental income, etc.) saw a 3% decrease in 2021-2022, from 16% ($49B) to 13% ($38B).

APPLICATIONS

In 2021-2022, CRA received 2,375 applications for charitable registration and 84 applications for other qualified donees (municipalities, amateur athletic associations, low-cost housing corporations, journalism organizations, etc.).

Only 1% of charities’ applications were refused. Almost three-quarters (71%) were registered, and the remainder were either incomplete, abandoned or withdrawn. For other qualified donees, the refusal rate much higher at 13%.

Why were charities and other qualified donees denied registration? The report lists several reasons: non-charitable activities, acting as a conduit, lack of direction and control, lack of information and promotion of sport.

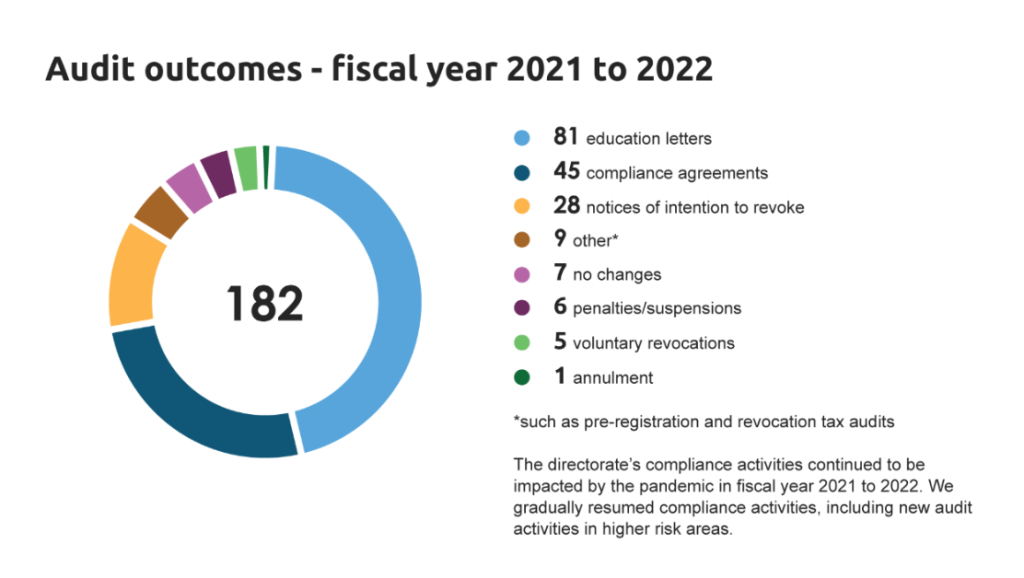

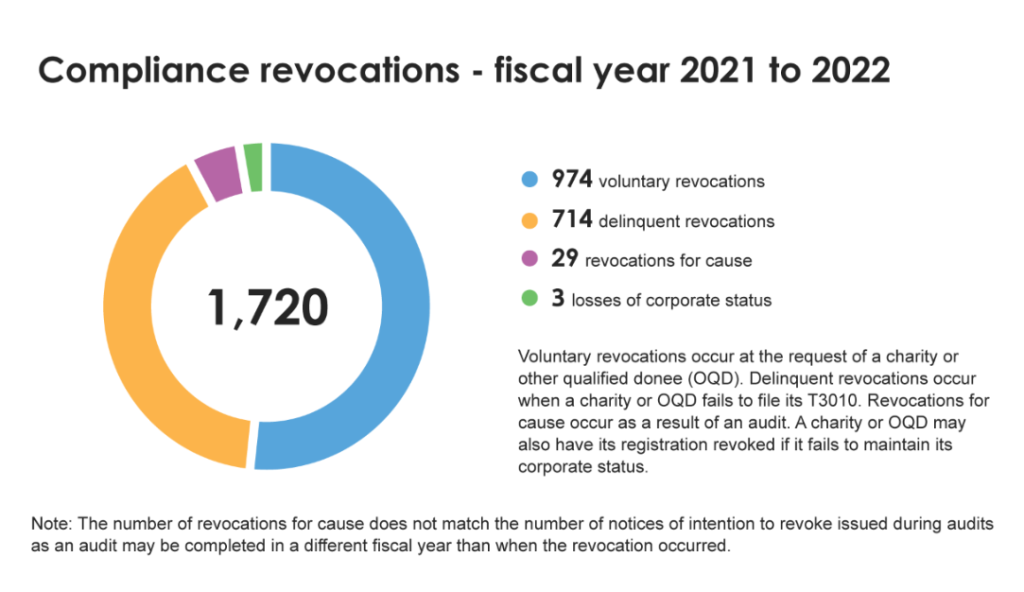

AUDITS & COMPLIANCE

As of March 31, 2022, there were 85,891 charities in Canada, 74,615 of which are registered charities. The rest were public and private foundations.

In 2021-2022 there were 182 audit outcomes, the majority of which resulted in education letters (81), followed by compliance agreements (45). There were also some penalties (6), voluntary revocations (5), one annulment and notices of intention to revoke (28). For seven audits, no changes resulted.

CRA identified several of its common non-compliance findings from audits: incomplete or incorrect return, incomplete or inaccurate donation receipts, inadequate books and records.

Looking at CRA’s data on compliance revocations, the overwhelming majority of revocations are “delinquent” and voluntary revocations. Delinquent means a charity or other qualified donee failed to file a T3010. In 2021-2022 only 29 were revoked for cause.

POLICY PRIORITIES

CRA publishes a wide variety of guidance documents to help charities understand their responsibilities, obligations and opportunities. These policy guidance products are developed through engagement with the charitable sector, other governments and departments. In 2021-2022, the CRA started to work on guidance including:

Receipting

Right now, the receipting guidance is not contained in a single document. Instead, there are multiple guidance documents, including CPC-009, Official donation receipts by a newly registered charity, published in 1993; CPC-010, Issuing a receipt in a name other than the donor’s, published in 1994; CPS-007, RCAAAs: receipts-issuing policy, published in 1995; CPS-014, Computer-generated receipts, published in 2000.

Related business

The current guidance, CPS-019 What is a related business was published in 2003.

Fundraising

The current guidance, CG-013, Fundraising by registered charities, was published in 2012.

Annulment

There is no current standalone guidance on annulment.

Housing

There are several guidance documents related to housing, including CPC-004, Housing for Seniors (Life-Tenancy Agreement), published in 1992; CG-022, Housing and charitable registration, published in 2014); CG-025, Qualified done: Low-cost housing corporation for the aged, published in 2016.

Management and administration expenses

Current information about management and administration expenses is found in CRA’s guide to Completing the Form T3010, addressing Section D – Financial Information (D4 – Expenditures) and Schedule 6, Detailed Financial Information (Statement of Operations).

Protection of the environment

The current guidance, CSP-E08, Environment, was published in 2003; SCP-E05, Ecologically sensitive land, was also published in 2003.

Expenses incurred by volunteers

The current guidance, CPC-025, Expenses incurred by volunteers, was published in 2003.

This is a long list – it shows that the CRA has a lot of work on the go, and charities should be ready to see a wide variety of new guidance published over the next few years. If your charity has ideas, insights or suggestions about any of these topics, please share those with us! We engage with CRA in a variety of ways, including through the Technical Issues Working Group, and your input can help inform our interactions and proposals for workable solutions.

The content provided in this blog is for general information purposes and does not constitute legal or professional advice. Every organization’s circumstances are unique. Before acting on the basis of information contained in this blog, readers should consult with a qualified lawyer for advice specific to their situation.